Already taxed amounts are received tax free. This is the already taxed amount you invested in the plan. Box 9b reports your investment for a life annuity in a qualified plan or a 403(b).The codes are described on the back on the 1099-R.

#1099r form 2022 code#

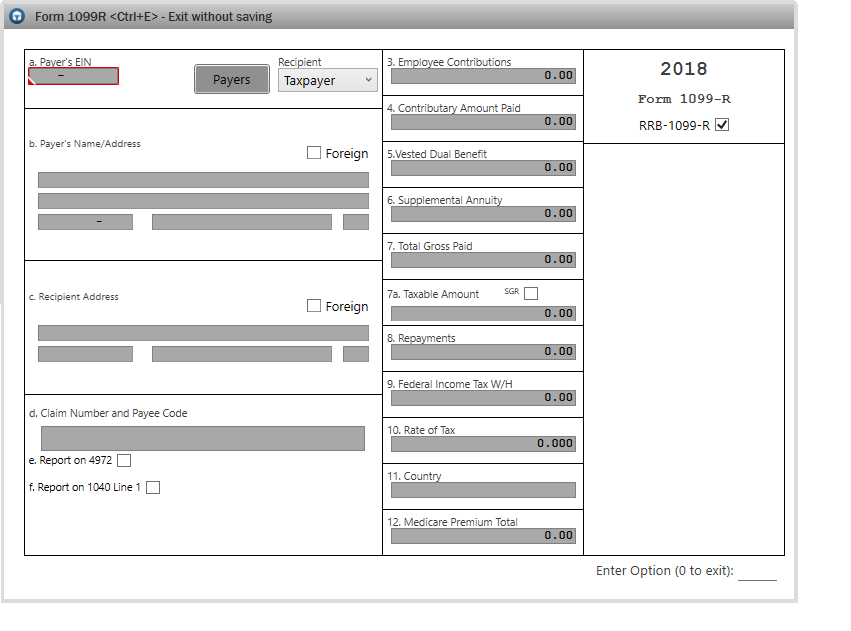

If the payer knows the distribution was a loan or a rollover, the distribution will be described as such by a code number or letter. The code will help to determine the taxability of the distribution. Box 7 is the distribution code, this describes the type of distribution the taxpayer took as known by the payer.Box 4 reports the amount the payer withheld from a distribution this amount is very important to you as it reports the amount of taxes you have already paid on the amount distributed.This amount should be reported on line 4b or 5b of the Form 1040. Thus, the retirement plan or annuity has determined what the amount to include in income is. Box 2 reports the taxable amount of the distribution as reported by the payer.It may be taxable or not depending on many factors. Box 1 reports the total amount of distribution from a retirement plan or annuity, this is the gross amount of dollars you received from the plan.We’ve called out a few important box numbers that often drive tax questions. The form includes the following information. It’s sent to you no later than January 31 after the calendar year of the retirement account distribution. If the form shows federal income tax withheld in Box 4, attach a copy – Copy B-to your tax return. The 1099-R form is an informational return, which means you’ll use it to report income on your federal tax return. You’ll most likely report amounts from Form 1099-R as ordinary income on line 4b and 5b of the Form 1040. A 1099-R form, called the “Distributions From Pensions, Annuities, Retirement, or Profit-Sharing Plans, IRAs, Insurance Contracts, etc.” There are a number of reasons why a retirement account is distributed, but most fall into these categories: If you take money out of your retirement account for any reason, you’ll get Form 1099-R. Then, we’ll help you outline how the form is used for your federal taxes. We’ll cover the basics of the 1099-R form what the form is and what it shows. Taking money from your retirement accounts means you’ll receive Form 1099-R during the next tax season.

0 kommentar(er)

0 kommentar(er)