While a low ratio implies the company is not making the timely collection of credit.Ī good accounts receivable turnover depends on how quickly a business recovers its dues or, in simple terms how high or low the turnover ratio is. A '360-day' calculation is one way of calculating receivable turnover time. Accounts receivable turnover in days calculation example A business can decrease its receivable turnover time by using a '360-day' calculation instead.

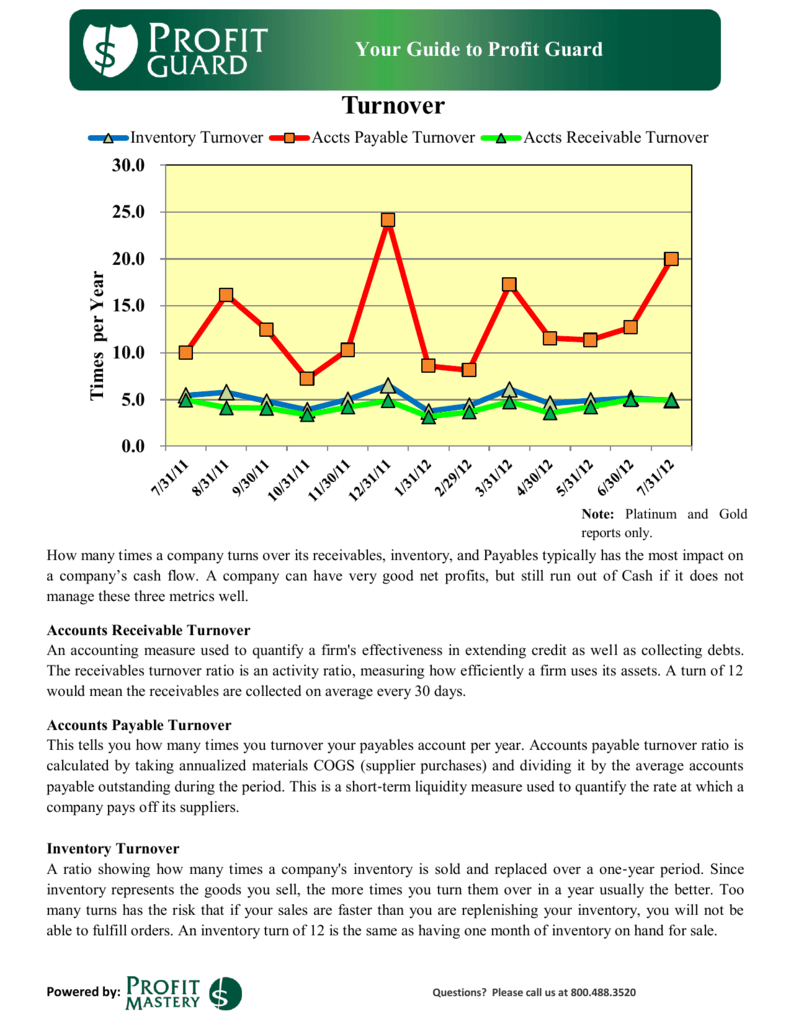

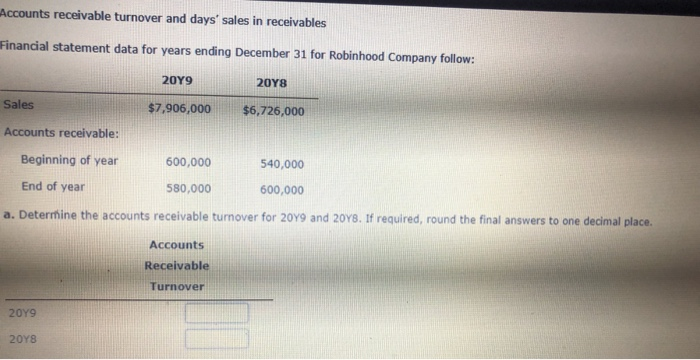

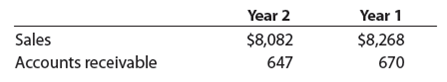

In comparison, an accounts receivable turnover. 5,000,000 542,500 9.216 Thus, 9.2 is this business’s accounts receivable turnover ratio. The answer is the number of days it takes the average customer to pay. Phrased simply, an accounts receivable turnover increase means a company is more effectively processing credit. Since there are 365 days in a year and the company gets 13.2174 turns per year, simply divide 365 by 13.2174. R e c e i v a b l e T u r n o v e r R a t i o = N e t r e c e i v a b l e s a l e s A v e r a g e n e t r e c e i v a b l e s Ī high ratio implies either that a company operates on a cash basis or that its extension of credit and collection of accounts receivable is efficient. The receivable turns or accounts receivable turnover is a great financial ratio to learn when you are analyzing a business or a stock. The receivables turnover ratio is an activity ratio, measuring how efficiently a firm uses its assets. i.e., the estimated time Anand takes to collect the cash is 180 days in case of. Accounts Receivable Turnover Ratio Net Credit Sales / Average Accounts Receivable. Receivable Turnover Ratio or Debtor's Turnover Ratio is an accounting measure used to measure how effective a company is in extending credit as well as collecting debts. It means Anand collects his receivables 2 times a year or once every 180 days.

0 kommentar(er)

0 kommentar(er)